Much like filing your business’s IRS information returns, There is certainly a benefit to selecting a licensed service provider. This allows aml filing services businesses to better track the position in their studies, sustain easily obtainable information, and entire studies with significantly less handbook knowledge entry.

E. 6. Is a 3rd-celebration courier or shipping service employee who only provides documents that produce or sign-up a reporting enterprise an organization applicant?

file. 1. Will a reporting business ought to report another information Besides information about its useful homeowners?

The thirty times commences after the corporation becomes aware of or has explanation to grasp of the inaccuracy in a prior report. Any reporting business that no longer satisfies the necessities of an exemption from reporting shall file its report within 30 calendar times soon after it now not qualifies for the exemption.

right or indirectly personal or Regulate 25% or maybe more of the “possession passions” with the reporting organization.

Unlimited usage of Tax industry experts: bought a certain dilemma a couple of tax rule? You’ll have unlimited messaging obtain specifically with-while in the software package to our crew of tax authorities to get the accounting and tax responses you would like.

The form is necessary as part of the 2021 Corporate Transparency Act. This act aims to reduce income laundering and the concealment of illicit money by focusing on shell companies and a number of other entities.

A different time period that can occur up during the report is the corporate applicant. This really is the individual who right documents the document that registered the reporting organization or the individual who was mostly answerable for the filing when there is more than one.

Moreover, up to date stories are essential when insignificant information modifications, similar to a constrained legal responsibility business’s manager with substantial Command switching their home home.

Observe that a “partnership agent” or “tax matters associate” serving in the function of a selected agent with the reporting firm could qualify for your “nominee, intermediary, custodian, or agent” exception with the helpful proprietor definition.

FincenFetch backlinks are branded along with your firm’s logo, giving your company a custom made Device to electricity FinCEN filings to your purchasers’ reporting corporations.

No. A advantageous proprietor of a corporation is any unique who, specifically or indirectly, physical exercises considerable Regulate around a reporting company, or who owns or controls at the very least twenty five % from the ownership interests of the reporting enterprise.

The Hartford just isn't responsible for and tends to make no representation or warranty concerning the contents, completeness, precision or stability of any material within this informative article or on these types of web pages. Your utilization of information and use of these non-Hartford web pages is at your individual possibility. you need to constantly check with knowledgeable.

Other exemptions to the reporting prerequisites, such as the exemption for “tax-exempt entities,” may utilize to sure entities formed beneath Tribal legislation.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Katie Holmes Then & Now!

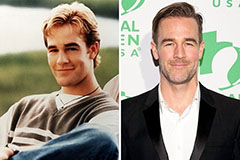

Katie Holmes Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!